ira gold companies

Add a review FollowOverview

-

Founded Date юни 12, 1901

-

Sectors Garments

-

Posted Jobs 0

-

Viewed 13

Company Description

The Comprehensive Guide To Gold IRA Accounts

irasgold https://irasgold.com.

irasgold https://irasgold.com.

On the earth of investing, diversification is essential to managing danger and ensuring lengthy-term financial stability. One more and more widespread solution to diversify an investment portfolio is thru the usage of a Gold Particular person Retirement Account (IRA). This article will discover what a Gold IRA is, how it really works, its advantages and drawbacks, and important considerations for investors involved in this unique asset class.

What is a Gold IRA?

A Gold IRA is a kind of self-directed Particular person Retirement Account that permits buyers to hold bodily gold and different precious metals as part of their retirement portfolio. Unlike traditional IRAs, which usually hold stocks, bonds, and mutual funds, a Gold IRA gives the opportunity to spend money on tangible assets that may function a hedge in opposition to inflation and economic uncertainty.

How Does a Gold IRA Work?

A Gold IRA operates similarly to a standard IRA, with a number of key differences:

- Custodian Requirement: Just like traditional IRAs, Gold IRAs require a custodian to handle the account and ensure compliance with IRS regulations. Nonetheless, not all custodians provide Gold IRAs, so it’s important to decide on one that specializes in valuable metals.

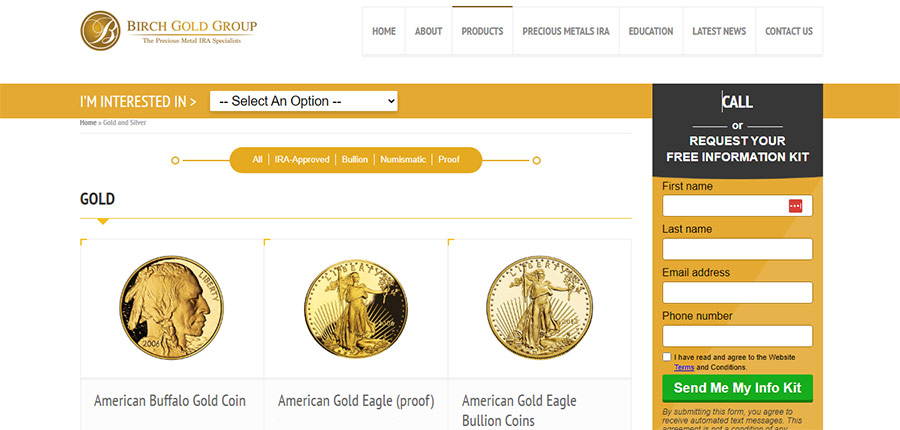

- Eligible Metals: The IRS has specific pointers concerning which sorts of gold and different precious metals can be held in a Gold IRA. Acceptable metals include gold bullion, coins, silver, platinum, and palladium that meet sure purity standards.

- Storage: Physical gold should be saved in an accepted depository, as individuals cannot keep the metals themselves for tax compliance causes. The custodian sometimes arranges for secure storage in a facility that meets IRS necessities.

- Tax Advantages: Like traditional IRAs, Gold IRAs offer tax-deferred growth. Because of this buyers don’t pay taxes on any positive factors until they withdraw funds throughout retirement. Moreover, contributions to a Gold IRA may be tax-deductible, relying on the individual’s revenue and tax state of affairs.

Advantages of a Gold IRA

- Hedge Towards Inflation: Gold has historically been viewed as a secure haven during instances of economic instability. When inflation rises, the worth of currency may decline, but gold often retains its purchasing energy. Traders usually turn to gold to protect their wealth in unsure financial instances.

- Portfolio Diversification: Adding gold to an funding portfolio will help cut back overall risk. Gold typically has a low correlation with conventional asset lessons, which means that its worth might not move in tandem with stocks and bonds. This diversification can lead to more stable returns over time.

- Tangible Asset: Not like stocks and bonds, gold is a physical asset that traders can hold in their hands. This tangibility can provide a way of security for these concerned about the volatility of monetary markets.

- Potential for Development: Whereas gold is commonly seen as a stable funding, it also has the potential for appreciation. As demand for gold increases because of components like industrial use or geopolitical tensions, its worth can rise, offering capital beneficial properties for traders.

Drawbacks of a Gold IRA

- Larger Charges: Gold IRAs typically include increased fees than conventional IRAs. These charges can embody setup fees, annual upkeep charges, and storage charges for the bodily gold. Investors ought to rigorously consider these prices when evaluating whether or not a Gold IRA is true for them.

- Limited Investment Options: While Gold IRAs permit for funding in precious metals, they don’t provide the same range of investment options as traditional IRAs. This limitation might not swimsuit all buyers, particularly those looking to diversify inside other asset classes.

- Market Volatility: Although gold is generally considered a secure funding, its value can be unstable within the brief time period. Components equivalent to changes in interest rates, foreign money fluctuations, and geopolitical occasions can all influence gold prices. Traders ought to be prepared for potential fluctuations in value.

- Regulatory Compliance: Gold IRAs must adhere to strict IRS regulations relating to the types of metals that can be held and how they’re saved. Failure to adjust to these rules can result in penalties and taxes, so it is crucial to work with a knowledgeable custodian.

Important Issues for Buyers

- Analysis Custodians: Not all custodians are created equal. It’s vital to research and select a good custodian with experience in managing Gold IRAs. Search for critiques, rankings, and any relevant certifications.

- Perceive the IRS Guidelines: Familiarize your self with IRS rules concerning Gold IRAs. This consists of understanding which metals are eligible, storage requirements, and reporting obligations.

- Evaluate Your Investment Goals: Before investing in a Gold IRA, consider your total investment technique and objectives. Determine how a lot of your portfolio you want to allocate to precious metals and whether a Gold IRA aligns along with your lengthy-term monetary plans.

- Seek the advice of a Monetary Advisor: If you’re not sure about whether a Gold IRA is best for you, consider consulting a monetary advisor. They’ll provide customized advice based mostly on your particular person financial situation and show you how to make informed investment choices.

Conclusion

A Gold IRA is usually a precious addition to a diversified funding portfolio, offering unique advantages equivalent to safety towards inflation and a hedge during financial downturns. However, potential investors ought to rigorously weigh the benefits and disadvantages, consider their private investment objectives, and conduct thorough analysis before making a decision. With the correct strategy, a Gold IRA may help safe your monetary future and supply peace of mind as you plan for retirement.